- Energy with Carlos

- Posts

- Major Energy Policy Update: House Republicans Propose Phasing Out Solar and Wind Tax Credits

Major Energy Policy Update: House Republicans Propose Phasing Out Solar and Wind Tax Credits

Overview

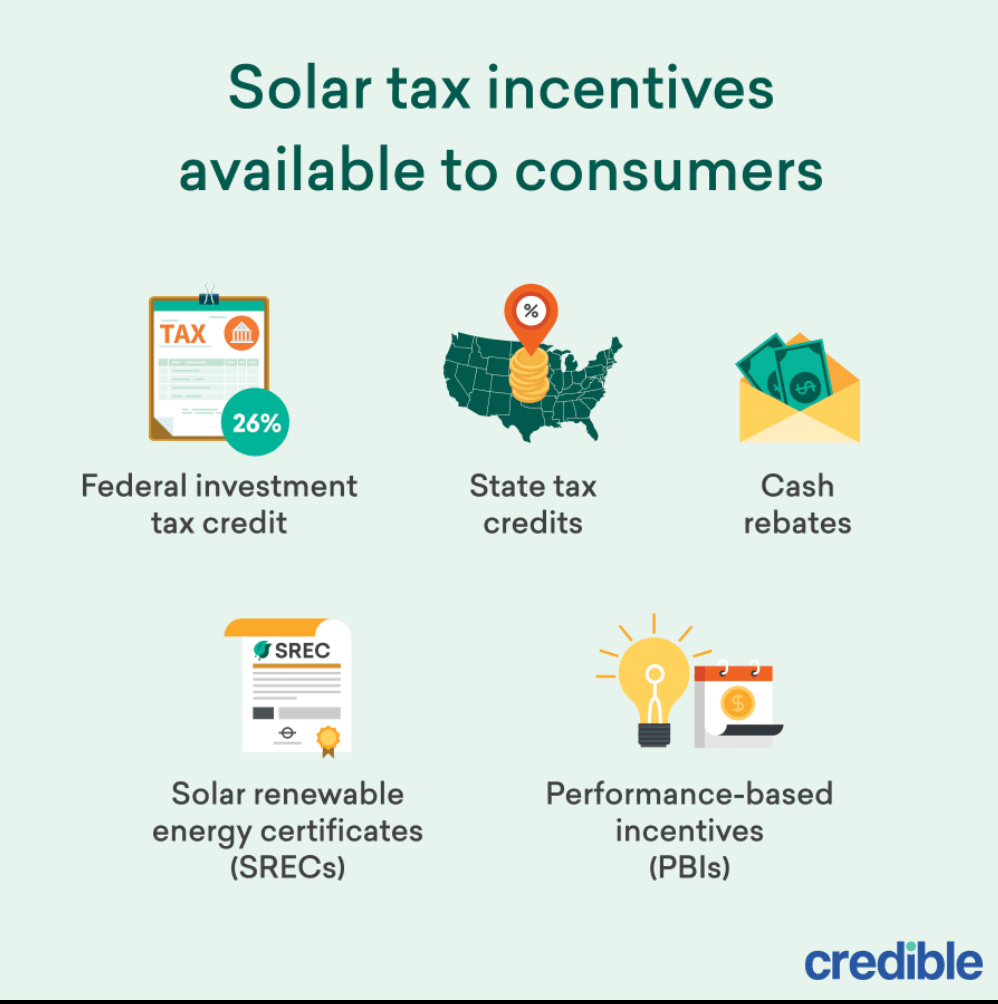

A group of House Republicans has introduced the "Ending Intermittent Energy Subsidies Act," aiming to phase out federal tax credits for solar and wind energy over a five-year period. The proposed legislation seeks to reduce the Investment Tax Credit (ITC) and Production Tax Credit (PTC) by 20% annually, effectively eliminating them by 2030. The bill maintains incentives for nuclear, hydroelectric, and geothermal energy sources.

Key Provisions

Gradual Reduction of Tax Credits: The ITC and PTC for solar and wind projects would decrease by 20% each year over five years.

Elimination of Transferability: The bill proposes ending the transferability of these tax credits, a mechanism that has facilitated approximately $25 billion in clean energy deals in 2024 alone.

Retention of Other Renewable Incentives: Tax credits for nuclear, hydroelectric, and geothermal energy would remain unaffected.

Rationale Behind the Proposal

Proponents argue that solar and wind technologies have matured and no longer require federal subsidies to compete in the energy market. Representative Julie Fedorchak (R-ND) stated, “By continuing to incentivize these intermittent energy sources through generous tax credits, we’re distorting energy markets and sending the absolute wrong signal to investors.”

Potential Impacts

Increased Energy Costs: Analysts project that residential electric bills could rise by approximately 7%, while small business energy costs might increase by 10% by 2026.

Investment Uncertainty: The proposed changes could affect over $500 billion in private capital investments catalyzed by tax credits since 2022.

Job Market Effects: The rollback of clean energy initiatives has already led to significant job losses in the U.S., with approximately 20,000 clean energy jobs lost since the November election and an additional 40,000 at risk.

Industry Response

The renewable energy sector has expressed concern over the proposed legislation. The Solar Energy Industries Association (SEIA) reported that solar energy accounted for 84% of new electricity generation capacity in the U.S. in 2024, largely driven by subsidies from the Inflation Reduction Act (IRA). The potential removal of these tax credits could slow the growth of renewable energy projects and investments.

Conclusion

The "Ending Intermittent Energy Subsidies Act" represents a significant shift in U.S. energy policy, with potential implications for the renewable energy sector, energy costs, and job markets. As the bill progresses through Congress, stakeholders across the energy industry will be closely monitoring its developments and preparing for potential impacts.

Sources for Further Reading

PV Magazine USA – Congress proposes bill to phase out solar and wind tax credits

Financial Times – Clean energy jobs fall amid rollback of green tax credits

Reuters – Solar accounted for 84% of new US power added in 2024, report says

Solar Energy Industries Association (SEIA) – https://www.seia.org

U.S. Congress Legislation Tracker – https://www.congress.gov

If you’ve been thinking about making your home more energy-efficient or switching to solar, now is the perfect time to take action. Reach out, and let’s explore the best options for you.

Call or text: 617-386-9608

Email: [email protected]

Let’s work together to lower your energy costs and bring clean, affordable energy to your home.